kentucky transfer tax calculator

For Kentucky it will always be at 6. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Transfer Tax Alameda County California Who Pays What

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

. Kentucky Income Tax Calculator 2021 If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. The tax estimator above only includes a single 75 service fee. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered.

Your household income location filing status and number of personal exemptions. How to Calculate Kentucky Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. 35000 income Single parent with one child - tax 1676.

Learn more about transfer taxes in Kentucky. Actual amounts are subject to change based on tax rate changes. 1 of each year.

50000 income Married with one child - tax 2526. Citizen Tax Calculator Enter your state individual income tax payment Select an Income Estimate OR 417807 111644 138828 79679 69640 182402 Education Medicaid Postsecondary Education Human Serv. Denotes required field Calculate.

If you are under age 60 at retirement and you have less than 27 years Kentucky Service your benefit will be less than the basic annuity estimated below. In the case of any deed not a gift the amount of the full actual consideration therefor paid or to be paid including the amount of any lien or liens thereon. Kentucky Alcohol Tax.

On any amount above 400000 you would have to pay the full 2. Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. 25000 income Single with no children - tax 1136.

Kentucky transfer tax. For comparison the median home value in. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Education417807 Medicaid111644 Category Percentage. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Welcome to the TransferExcise Tax Calculator.

Denotes required field. Kentucky does not charge any additional local or use tax. Real estate in Kentucky is typically assessed through a mass appraisal.

60000 income Single parent with one child - tax 3126. Kentucky Property Tax Rules. The median property tax on a.

To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For example on a 500000 home a first. The base state sales tax rate in Kentucky is 6.

Please see the KTRS pamphlet for Service Retirement. The tax is computed at the rate of 50 for each 500 of value or fraction thereof. If the deed is a gift or indicates nominal consideration the tax is paid on the estimated price the property would bring in an open market.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Property Information Property State. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

View all NYC NYS Transfer Tax rates. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. Delaware DE Transfer Tax.

Select your district below for district tax rates then enter your assessed value to see results. All rates are per 100. Tax Estimator Assessment Value Homestead Tax Exemption Check this box if this is vacant land Please note that this is an estimated amount.

Download Or Email Form 740-ES More Fillable Forms Register and Subscribe Now. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

Expect to pay around 50 in Kentucky though you may be able to negotiate for the buyer to cover this cost. Find your Kentucky combined state and local tax rate. In the case of a gift or any deed with nominal consideration or without stated consideration the estimated price the property would bring in an.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

Justice All Other NoteThis calculator is for illustrative purposes only. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. 80000 income Married with two children - tax 3251.

For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky. The transfer tax is imposed upon the grantor The tax is computed at the rate of 50 for each 500 of value or fraction thereof.

The combined NYC and NYS Transfer Tax for sellers is between 14 and 2075 depending on the sale price. Your state or local government charges a fee for legally recording a propertys deed and mortgage information. Your average tax rate is.

Select an Income Estimate. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Kentucky income tax calculator is designed to provide a salary example with salary deductions made in Kentucky. Calculator Mode Calculate.

The base state sales tax rate in Kentucky is 6. Tax Calculator Tax Calculator Instructions. Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. After a few seconds you will be provided with a full breakdown of the tax you are paying. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. All property that is not. The tax is computed at the rate of 50 for each 500 of value or fraction thereof.

Property Information Property State. Welcome to the TransferExcise Tax Calculator.

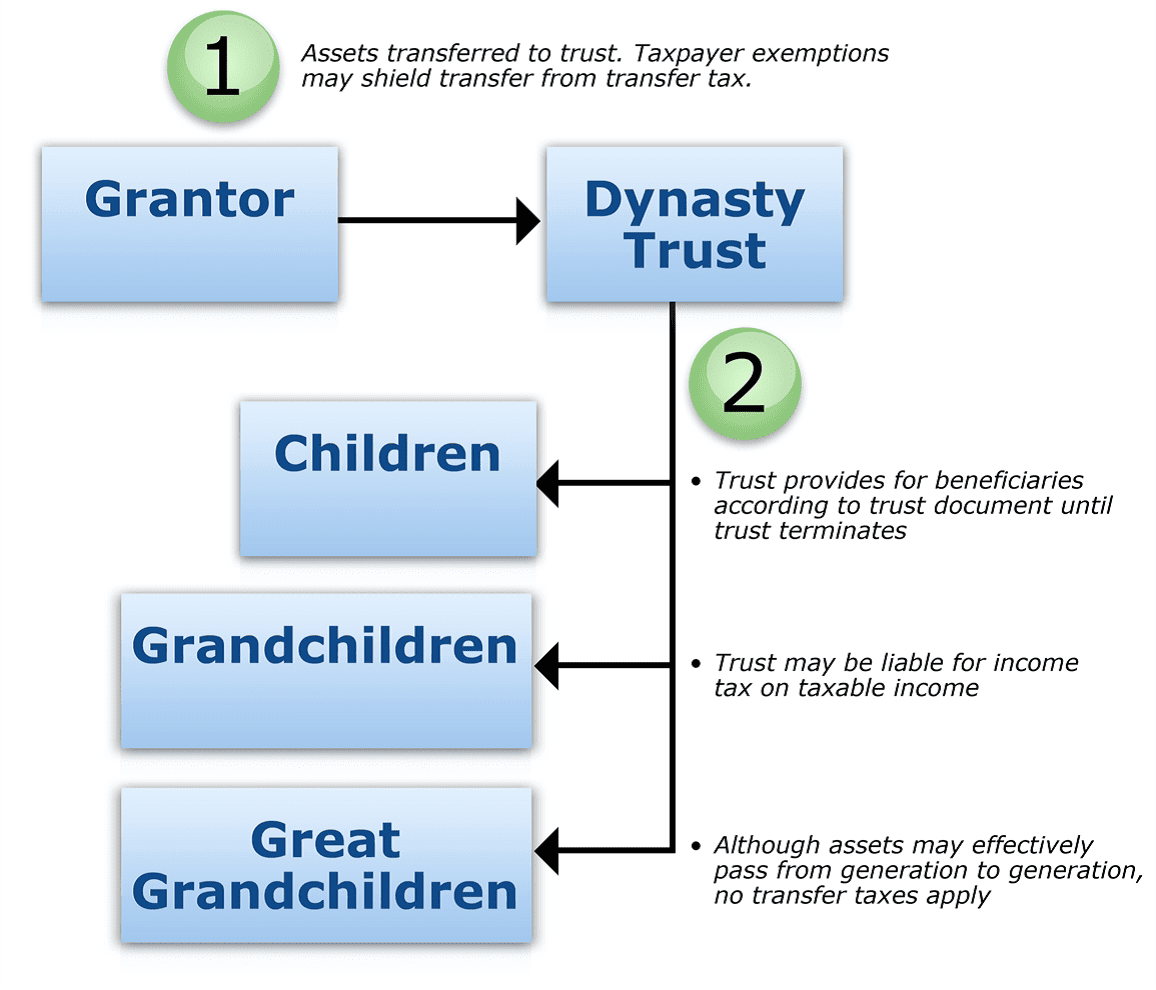

Is Your Legacy In A Dynast Trust Cwm

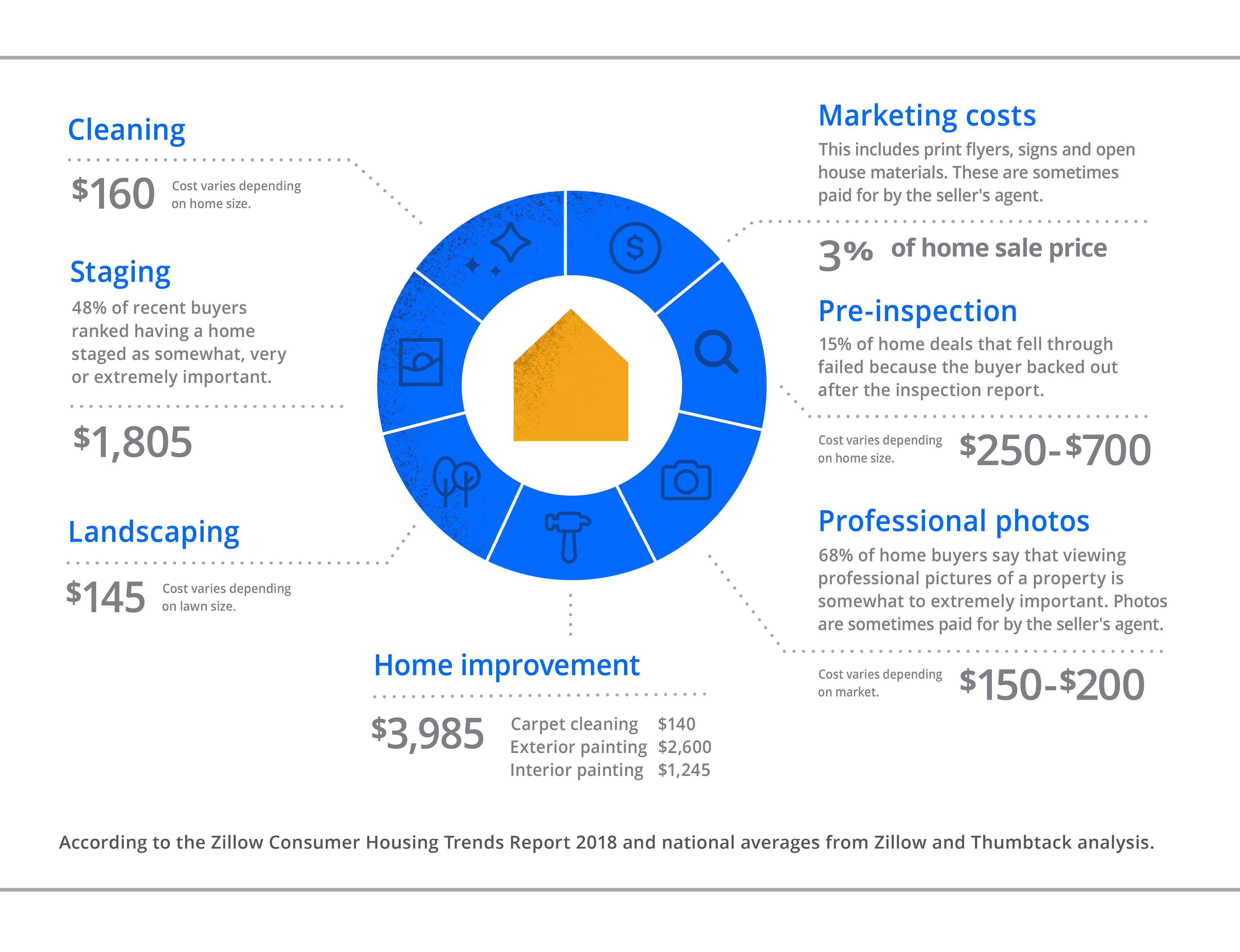

How Much Does It Cost To Sell A House Zillow

Transfer Tax Who Pays What In Washington Dc

Transfer Tax In Marin County California Who Pays What

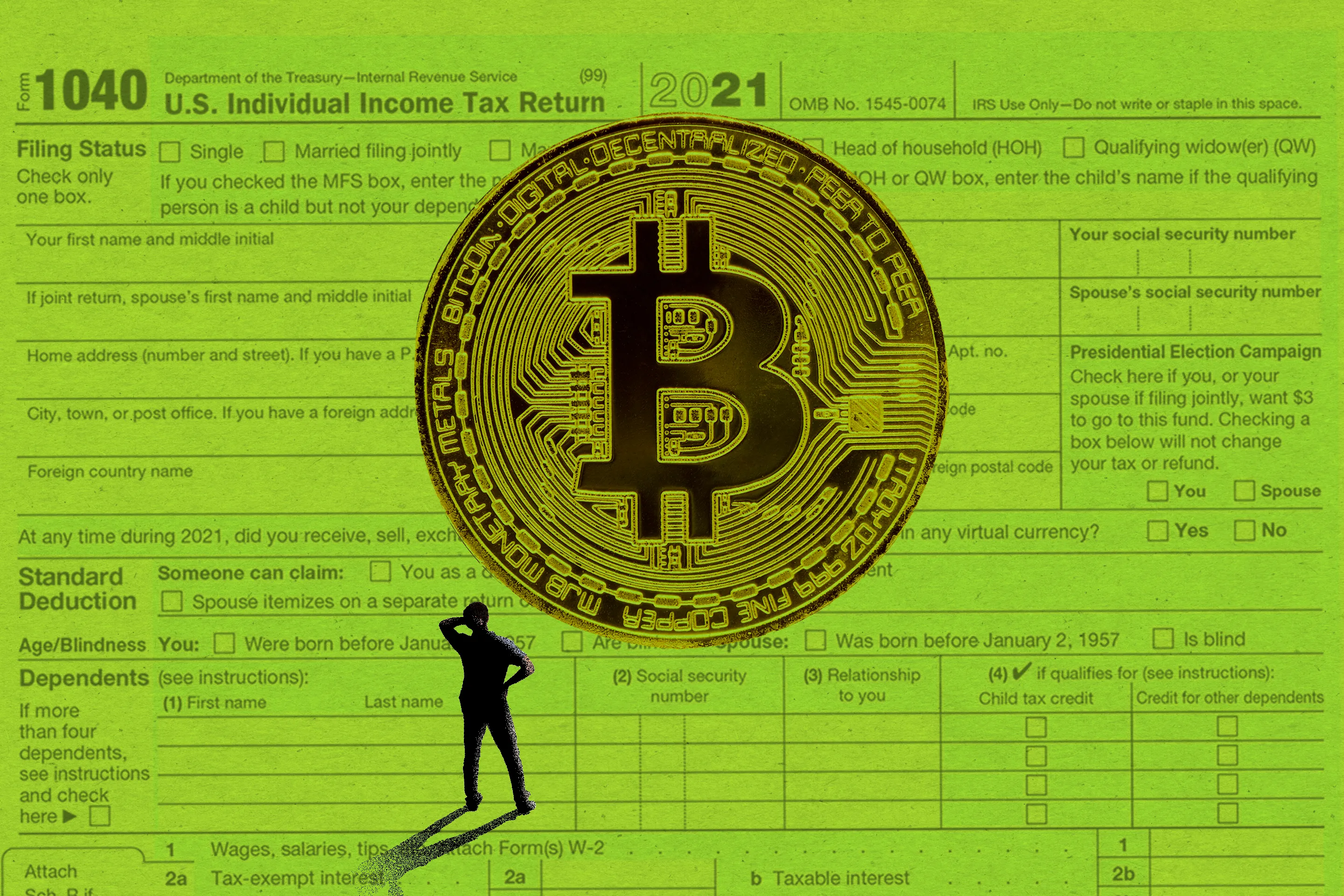

Crypto Taxes How To Calculate What You Owe To The Irs Money

A Breakdown Of Transfer Tax In Real Estate Upnest

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Transfer Tax In San Luis Obispo County California Who Pays What

Transfer Tax In Marin County California Who Pays What

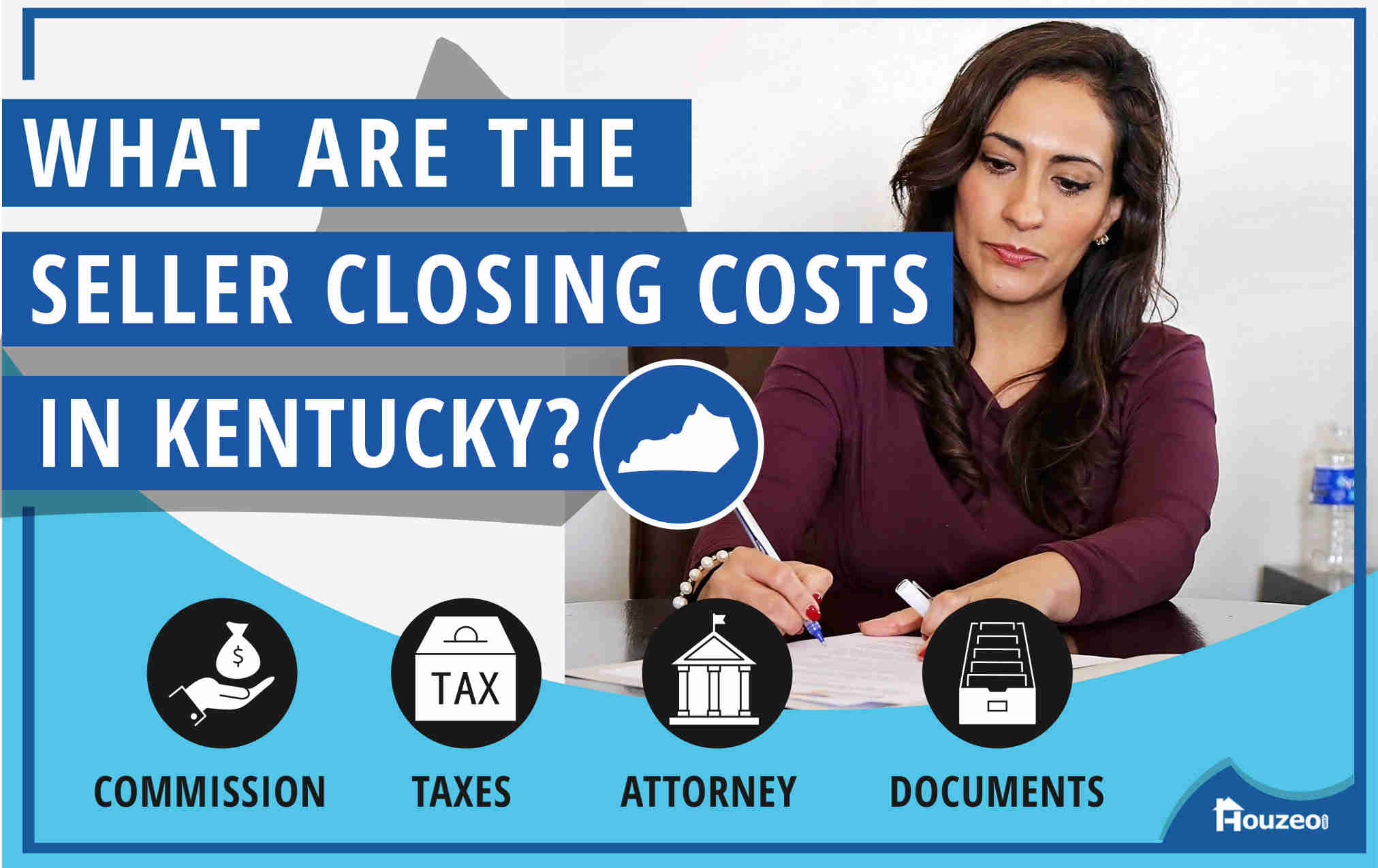

What Are The Seller Closing Costs In Kentucky Houzeo Blog

Jefferson County Ky Property Tax Calculator Smartasset

Transfer Tax Calculator 2022 For All 50 States

Capital Gains Tax In Kentucky What You Need To Know

What You Should Know About Contra Costa County Transfer Tax